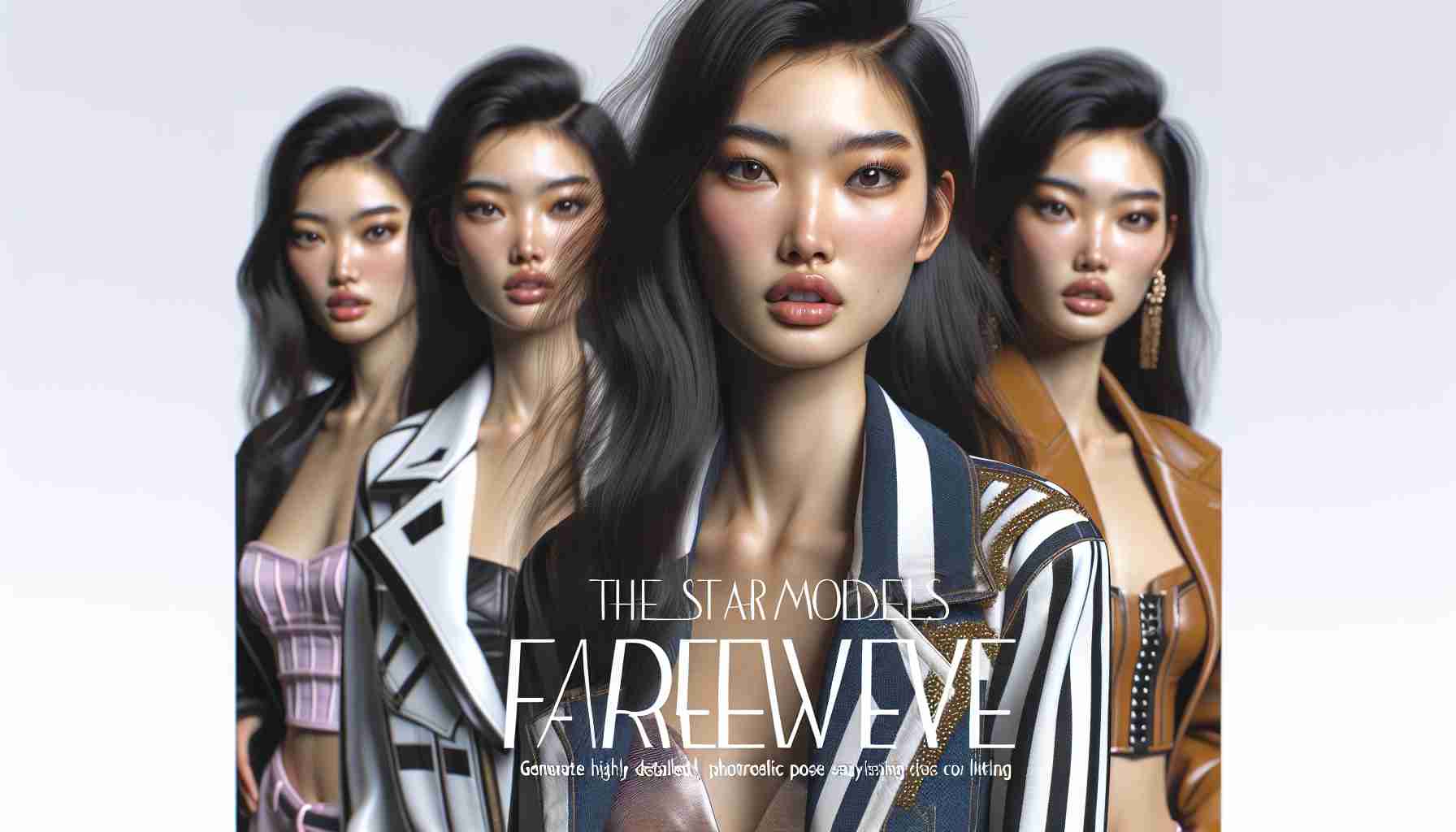

تكريم لرحلة ساي أوكازاكي الأيقونية

منذ ظهورها الأول في عام 2015، كانت ساي أوكازاكي شخصية لامعة في عالم عرض الأزياء، تمثل جوهر راي لمدة تقارب التسع سنوات. ومع تخليها عن دورها كنجمة غلاف المجلة، يُعرض معرض خاص يبرز جميع لقطاتها الجميلة على الأغلفة، مما يجعله عرضاً لا بد من مشاهدته لمحبيها.

بدأت رحلتها مع أول جلسة تصوير لها على الغلاف جنباً إلى جنب مع زميلاتها في يوليو 2018، حيث أسرّت القلوب بابتسامتها المشعة. تعكس كل غلاف تالٍ ليس فقط نموها كعارضة أزياء، ولكن أيضاً تطورها في صناعة الأزياء. وفي فبراير 2019، مع دخولها عامها الثاني كعارضة مكرسة، عبرت عن رغبتها في تجسيد شخصيات نسائية متنوعة، مما أظهر مزيدًا من مرونتها.

من المهم أن الغلاف الفردي الأول لها في مارس 2020 كان علامة بارزة في مسيرتها المهنية، حلماً تحقق بعد سنوات من العمل الجاد. من خلال مختلف جلسات التصوير، بما في ذلك تعاون ملحوظ مع العارضة زميلتها أيري سوزوكي، شهد المعجبون الصداقة العميقة والإبداع الذي ميز فترة وجودها في راي.

تحتوي كل غلاف على لحظات فريدة، مثل مظهرها النادر بالشعر الأشقر لدور درامي، أو مرحها خلال مواضيع الصيف المشرقة. فيما تحتفل راي بمعالمها، كانت رحلة ساي داخل صفحاته استثنائية، culminating في غلافها الأخير في فبراير 2025 – وداع مليء بالحب يعبّر عن سعادتها الخاصة.

نهاية حقبة: الاحتفاء بتأثير ساي أوكازاكي على الأزياء وعرض الأزياء

مقدمة عن مسيرة ساي أوكازاكي

ساي أوكازاكي، شخصية رائعة في صناعة عرض الأزياء منذ ظهورها الأول في عام 2015، تركت علامة لا تمحى على مشهد الأزياء. مع وجودها المنضبط ونطاقها الديناميكي، تمثل ساي المجلة الأيقونية راي لمدة تقارب تسع سنوات. ومع تحولها بعيداً عن دورها كنجم غلاف المجلة، تتأمل صناعة الأزياء في إنجازاتها ومساهماتها الكبيرة.

إنجازات بارزة ومعالم

بدأت رحلة ساي مع أول جلسة تصوير لها على الغلاف في يوليو 2018 جنباً إلى جنب مع زملائها. على مر السنين، أصبحت معروفة بابتسامتها المشعة وقدرتها على تجسيد مواضيع متعددة، مما يعرض مرونتها والتزامها. كانت لحظة محورية في مسيرتها عندما حصلت على غلاف فردي في مارس 2020، مما يرمز إلى حلم تحقق بعد سنوات من العمل الجاد والعزيمة.

تمثيل متنوع في الأزياء

واحدة من السمات المميزة لمسيرة ساي هي قدرتها على التحول إلى شخصيات متعددة، تعكس الطبيعة المتعددة الأبعاد لملابس النساء. كل جلسة تصوير على الغلاف رواية، سواء كان تقديم جمالية أنيقة أو التقاط روح مرحة للصيف. لقد وضعت التزام ساي بتمثيل هويات النساء المتنوعة سابقة تُحتذى بها للعارضات المستقبليات.

تفاعل المعجبين والتعاون

تعاونت ساي، وخاصة شراكتها اللافتة مع العارضة زميلتها أيري سوزوكي، على إظهار روح قوية من الصداقة والإبداع، مما زاد من تقربها للمعجبين. لم تسلط هذه التعاونات الضوء على مواهبها الفردية فحسب، بل أرست أيضاً نموذجاً ملهمًا للتعاون والصداقة في الصناعة.

الاتجاهات القادمة المتأثرة بساء

بينما تتخلى ساي أوكازاكي عن الأضواء في راي، يبقى تأثيرها على الاتجاهات المستقبلية في الأزياء ملحوظًا. من المتوقع أن نشهد مزيدًا من العارضات يحتضنّ تنوع الأنوثة الذي روجت له. ومن المتوقع أن تتجه الصناعة نحو الشمولية والمرونة، مستوحاة من إرثها.

الإيجابيات والسلبيات لرحيل ساي

الإيجابيات:

– إرث المرونة: قدرة ساي على عرض أنماط متنوعة ألهمت العديد من العارضات الناشئات.

– تركيز على الشمولية: مهدت مسيرتها الطريق لتمثيل أوسع في عرض الأزياء.

السلبيات:

– فقدان نموذج يحتذى به: بالنسبة للعديد من المعجبات الشابات والعارضات الطموحات، يمثل رحيل ساي نهاية رحلة ملهمة.

– تغييرات في هوية العلامة التجارية: مع تقدم راي، قد تحتاج إلى إعادة تعريف هويتها بدون تجسيدها.

خاتمة

كانت رحلة ساي أوكازاكي مع راي استثنائية بكل المعاني. مع غلافها الأخير في فبراير 2025 الذي يمثل وداعاً مؤثراً، لن تُنسى مساهماتها في صناعة الأزياء. مع تطور الاتجاهات وبروز وجوه جديدة، سيتواصل إرث ساي في عالم عرض الأزياء.

للحصول على مزيد من الرؤى حول تطور عرض الأزياء واتجاهاتها، زر موقع راي.