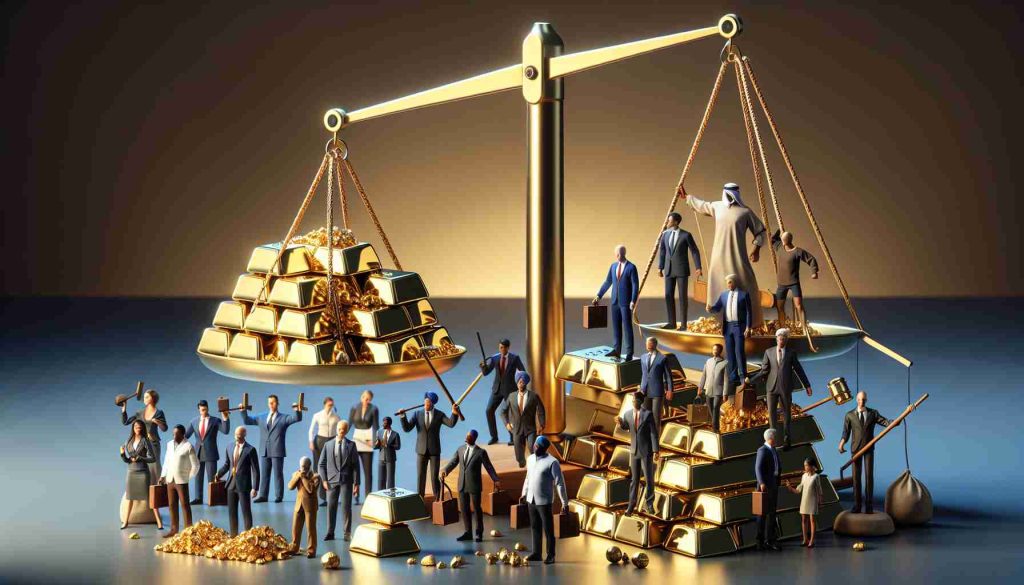

Gold prices remain stable in the market despite nearing a potential record high. Market analysts anticipate that consumer behavior will play a crucial role in shaping the future of gold valuation. Recent data revealed a shift in consumer preferences towards alternative investments, driving gold prices to hover around the $2,500 mark. This notable trend suggests a growing confidence in gold as a safe haven asset.

Consumer inflation data is expected to be a significant factor influencing gold prices in the coming days. Experts forecast a decline in inflation rates for the current period, potentially impacting the Federal Reserve’s decision-making process. A decrease in inflation is anticipated to fuel investor optimism, paving the way for substantial adjustments in interest rates.

Market volatility is on the horizon as traders prepare for the impending inflation report. The anticipated reduction in inflation figures might lead to a surge in demand for gold as a protective measure against economic uncertainties. The intricate relationship between inflation and gold prices continues to drive market dynamics, highlighting the pivotal role of consumer sentiment in shaping investment strategies.

Looking forward, gold prices are poised to experience fluctuations as investors align their positions with the evolving market conditions. The prospect of a significant interest rate cut in response to reduced inflation further underscores the strategic importance of gold in diversified portfolios. As consumer behavior evolves, the resilience of gold as a valuable asset class remains a focal point in the volatile landscape of financial markets.

The Impact of Consumer Behavior on Gold Prices: Unveiling Key Insights

Gold prices have shown remarkable stability in the financial landscape, inching closer to a potential record high. Market analysts remain keenly attuned to the role of consumer behavior in steering the trajectory of gold valuation, with recent data pointing towards intriguing shifts in this regard.

What are the emerging trends in consumer behavior influencing gold prices?

While the previous article touched on the preference for alternative investments, a deeper dive reveals nuances such as generational shifts impacting gold demand. Younger demographics, particularly millennials, are increasingly turning to gold as a store of value, hinting at a potentially prolonged bullish sentiment.

What are the key challenges or controversies associated with consumer behavior’s impact on gold prices?

One major challenge lies in the unpredictable nature of consumer sentiment. Changes in economic conditions, geopolitical events, or even social media trends can swiftly alter perceptions towards gold, leading to price volatility. Additionally, the interplay between consumer behavior and speculative trading activities adds a layer of complexity to price discovery mechanisms.

Advantages and Disadvantages of Consumer Behavior’s Influence on Gold Prices

On the positive side, consumer behavior injects a sense of dynamism into gold markets, fostering innovation in investment products and strategies. However, this very dynamism can also fuel excessive speculation or herd mentality, potentially distorting the intrinsic value of gold and amplifying market bubbles.

Exploring Further Insights and Resources

For a comprehensive understanding of consumer behavior’s impact on gold prices, exploring reputable sources such as Bloomberg can provide real-time market analyses and expert opinions. Keeping abreast of macroeconomic indicators and industry reports from organizations like the World Gold Council can offer valuable insights into the evolving landscape of gold investments.